July 2025 – The African Continental Free Trade Area (AfCFTA) Investment Protocol, which was adopted in February 2023, represents a significant milestone in the legal and economic integration of the African continent. It aligns with the objectives established by the African Union, with the aim of facilitating intra-African investment and promoting sustainable and inclusive development.

Drawing directly on the principles established in the 2016 Pan-African Investment Code (PAIC), the Protocol transforms these guidelines into a legally binding instrument. It lays the foundations for responsible investment, through a unified legal framework. The link between the two texts illustrates an assumed normative affiliation, transforming a body of principles into effective obligations.

The Protocol aims to resolve the difficulties posed by the coexistence of numerous bilateral investment treaties (BITs) between African countries. It explicitly provides for the progressive termination of these intra-African BITs (article 2), with a view to eliminating the legal contradictions and uncertainties that hinder investment flows. Article 5 establishes a mechanism for aligning national policies with continental objectives.

The Protocol imposes substantial obligations on investors (Articles 14 to 18), particularly in terms of transparency, social and environmental compliance, and the fight against corruption. Furthermore, it reinforces the eligibility criteria for treaty protection, thereby limiting the abusive practices of ‘treaty shopping’ or opportunistic investment without economic substance.

Article 10 clearly reaffirms the right of States to regulate their policies in the public interest. This principle of regulatory sovereignty is pivotal in achieving the optimal balance between fostering an attractive business environment and safeguarding national strategic objectives. It allows States to establish public policy measures without the concern of excessive sanctions or exposure to ICSID arbitration disputes.

From an operational point of view, the dispute settlement mechanism provides for a clear hierarchy between mediation, negotiation and arbitration (articles 20 to 25), and favours endogenous solutions via African judicial institutions.

The practical implications for investors are numerous. They will need to adapt their contractual and organisational practices, integrate robust ESG clauses into their projects, and demonstrate a real economic foothold in order to benefit from the protection framework. This creates a qualitative filter. It encourages structuring investment, aligned with African priorities and fosters the use of the protection offered by the new framework.

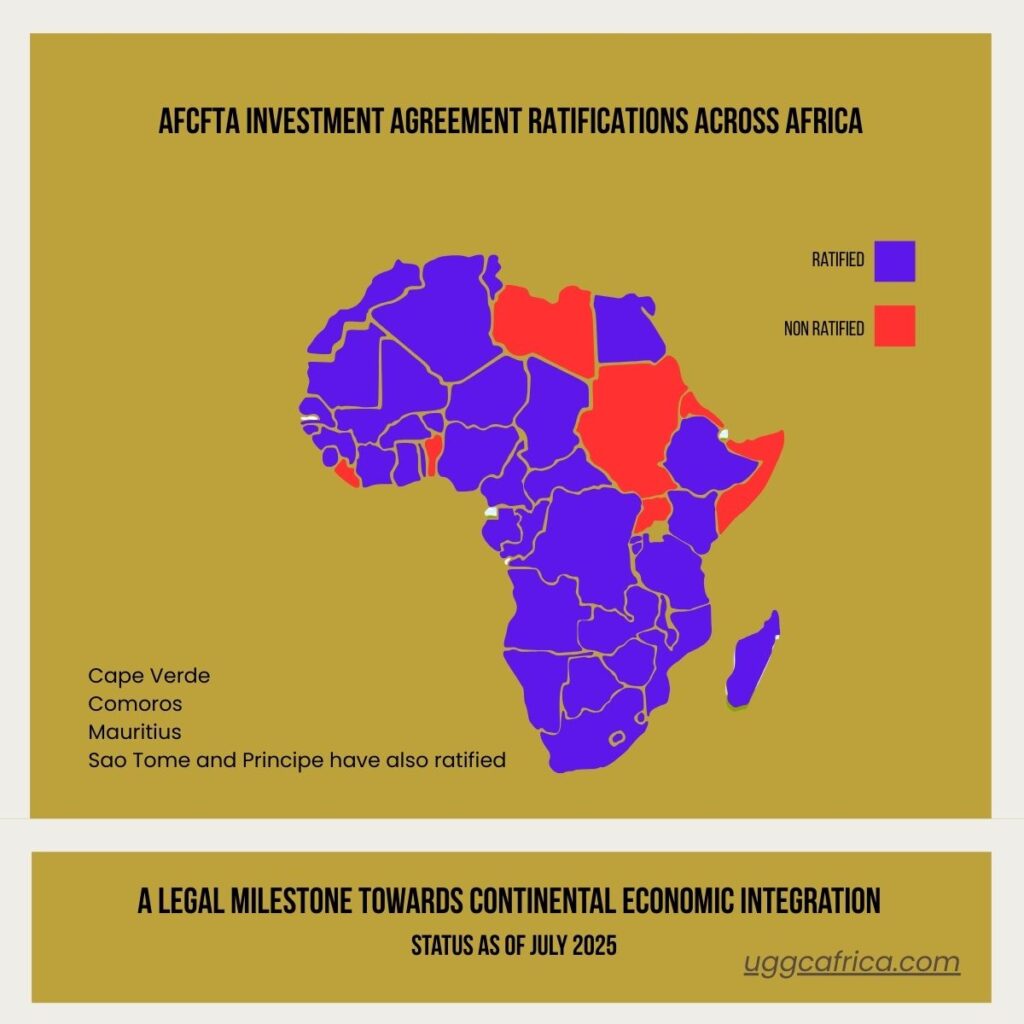

However, the implementation of the Protocol remains challenging. The success of the Protocol relies on the willingness of States to ratify, transpose and enforce these standards. The effectiveness of the Protocol in the medium term will be dependent on the development of administrative capacities, the establishment of regional legal convergences, and the implementation of monitoring mechanisms.

The AfCFTA Protocol thus represents a basis for convergence for African investment policies. It demonstrates the commitment of African States to collaborative thinking on their economic sovereignty, with the aim of achieving more inclusive and sustainable growth.